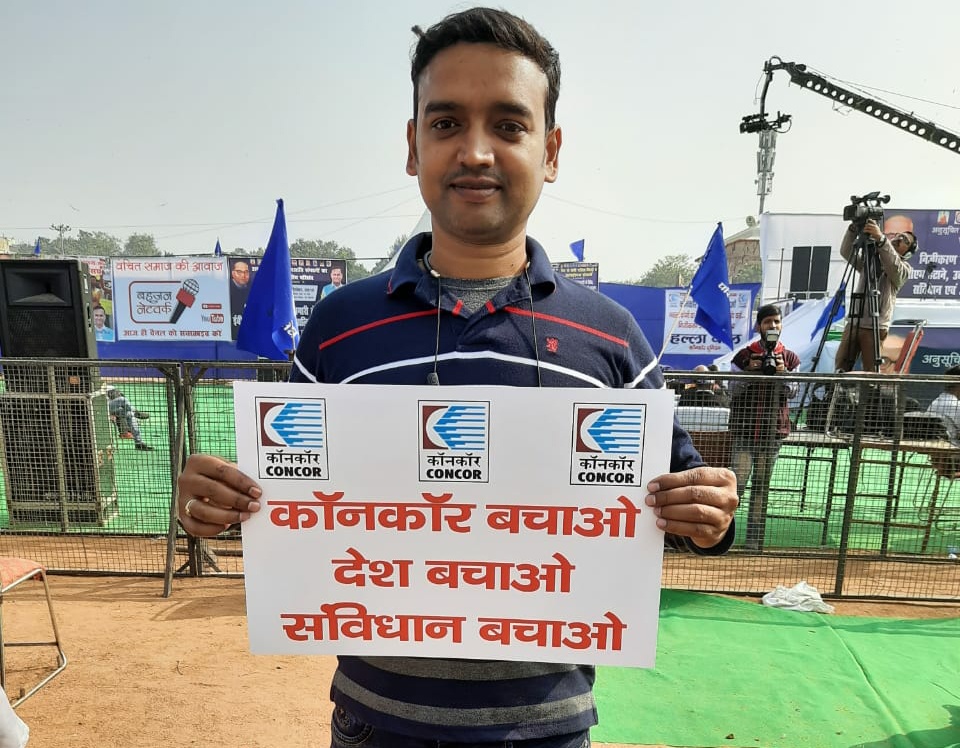

“CONCOR being sold off for only ₹ 5,500 crores!!”

CONCOR EoI for 30% stake sale this month -Sources

New Delhi : As per reliable sources, the disinvestment department ‘DIPAM’ will issue expression of interest (EoI) for railway PSU CONCOR this month with the stumbling block of railway land issues being on way to be resolved.

The government has decided to sell 30% of its stake in the company to a strategic partner, along with transfer of management control. The government currently holds 54.8% stake in CONCOR. CONCOR share price is Rs 588.80 (+22.45, 3.96%) at 2.30 pm on Thursday. The stake sale in this PSU will fetch the Centre Rs 5,500 crore.

The state-owned Container Corporation of India (CONCOR) is looking to reduce its dependence on terminals built on land owned by the Indian Railways for handling cargo containers.

CONCOR’s terminals built on Railways’ land have become issues in its privatisation, said sources. Railways’ land is an issue facing the strategic disinvestment of CONCOR. The deal cannot alter the basic rules laid down by the concession agreement signed between the private operators and the Indian Railways in 2007, which provides a level playing field to all.

If that land goes into private hands, then it will disturb the level playing field, sources said, adding this is an issue that the railways brass are at work to settle to facilitate issuing the EoI of CONCOR this month.

CONCOR currently gets land from the Indian Railways at a concessional rate. But since this is given to a new private operator, it may result in favour of the new entrant. So the land lease terms have to be re-worked which is on the way, official sources stated.

CONCOR is one of the three main entities up for strategic sale in the current fiscal along with Air India and BPCL whose main EoIs will be issued this fiscal, but actual action will start the next fiscal.

Air India EoI has already been issued, BPCL and CONCOR will be issued this month. The target for the current fiscal for disinvestment has been lowered to Rs 65,000 crore in view of the delay in sales of Air India, BPCL and CONCOR.

The next fiscal target is Rs 2.10 lakh crore on the back of these three sales along with the IPO of state insurer LIC. Credit Suisse said even the Rs 65,000 crore divestment target for FY20 looks high, as only Rs 28,000 crore has been raised so far.

It is learned that @concor_india being #sold_off for only Rs. 5500 crores !#strange !!#Looto_India_Movement is continue!!!@RailMinIndia@PiyushGoyal@PiyushGoyalOffc@PMOIndia@SecyDIPAM@FinMinIndia@airfindia@AIRFCOMMS@DrAshokTripath@PreRPF_Asso@IrpsOfficers

— kanafoosi.com (@kanafoosi) February 6, 2020

Input: IANS/Outlook